Climate Stories Episode #10 – Amanda Li (MBA 2018): Speeding Climate Change Through Project Finance Efficiencies

Spurred by this summer’s record heat, floods, and wildfires around the globe, businesses, educational institutions like Harvard University, legislatures, and think tanks are expanding their involvement in the search for climate change solutions. In Episode 10 of Climate Stories, HBS alumna, Amanda Li (MBA 2018), describes her efforts to drive innovation at the intersection of fintech and climate change.

“We are not going to meet our climate goals at the current rate and that has dire implications for the world… We need to dramatically accelerate deployment of capital into sustainable infrastructure projects.” – Amanda Li (MBA 2018), COO and co-founder of Banyan Infrastructure

Amanda Li grew up fascinated with the natural world. “I have always been a ‘crunchy’ person and first wanted to work out in the field,” Amanda said in an interview with Climate Stories. “I was inspired to preserve the mountains I climbed as a child.” Her father challenged her to look at it from a broader perspective. “My father, an entrepreneur and businessperson, guided me to look at how to maximize reach. If I could innovate on major systems like technology, policy, or markets, it would be more than saving one mountain, but entire ecosystems.”

Amanda’s goals remain lofty. As COO and co-founder of Banyan Infrastructure, she is developing fintech innovations to improve the speed and profitability for investing in sustainable infrastructure projects. Since 2018, Banyan Infrastructure has helped deploy and manage over $3 billion of capital towards sustainable infrastructure developments, including solar, energy efficiency, energy storage and more. However, Amanda calculates that more than $60 billion will be left on the table if financial institutions do not create greater efficiencies in sustainable infrastructure capital deployment.

Her timing for advocating for these changes is spot-on, given this summer’s passage of the Inflation Reduction Act (IRA). “The level of ‘act now’ generated by the IRA passage is incredible – like a shot of caffeine,” Amanda said. “Anyone hesitant about growth in sustainable investing and even those questioning ESG investments are realizing that there are profits to be made. They have to take part in this growing pie!”

Amanda is using 2022’s fourth quarter to prepare for that growth, adding staff and taking scores of inbound inquiries for Banyan’s services. “How does a bank quickly grow its portfolio while managing risk?” she asked. “They should definitely leverage technology and the next three months - before the IRA money begins to flow - is critical to get ready.” Specifically, small to medium projects are getting the largest boost. “Previously, a multi-family home in a low income community was often too small a project for a bank to finance installation of a solar project, for example. Now, there are direct incentives for these one-to-five megawatt projects. From tax credits, to a $27B national green bank facility with low income community targets, banks and funds that can do smaller deals will flourish. Banyan’s platform was made to help here, and can streamline the origination, underwriting, portfolio management paperwork and their attendant costs.”

This April, before the IRA was passed, Banyan raised an $8.2 million Series A round led by VoLo Earth Ventures with additional investment from Ulu Ventures, Vista Verde Capital, Nomadic Venture Partners and Industrious Ventures. The funding is allowing the company to ramp up hiring to take advantage of the tailwinds generated by the IRA.

Amanda and her colleagues framed their funding needs, in part, around research by McKinsey that has shown that for the world to achieve net-zero emissions in 2050, we need to grow the investment in climate focused infrastructure from $1 trillion to over $6 trillion annually. The World Economic Forum identified new sustainable buildings as a $24.7 trillion investment opportunity by 2030, in emerging markets alone.

No surprise – Amanda, an engineer by training, believes that financing of these new capital investments has been too slow. She and her company are working to close what they see as a major gap at the intersection of fintech and climate change.

“Our investors and Board are now focused on impact,” Amanda said. “They want us to model impact more aggressively. Everyone is seeing shifts in infrastructure reform. No one is investing in coal now. The trend is for cheaper solar, wind, renewables, etc. It is becoming a growth area for those who want exposure.”

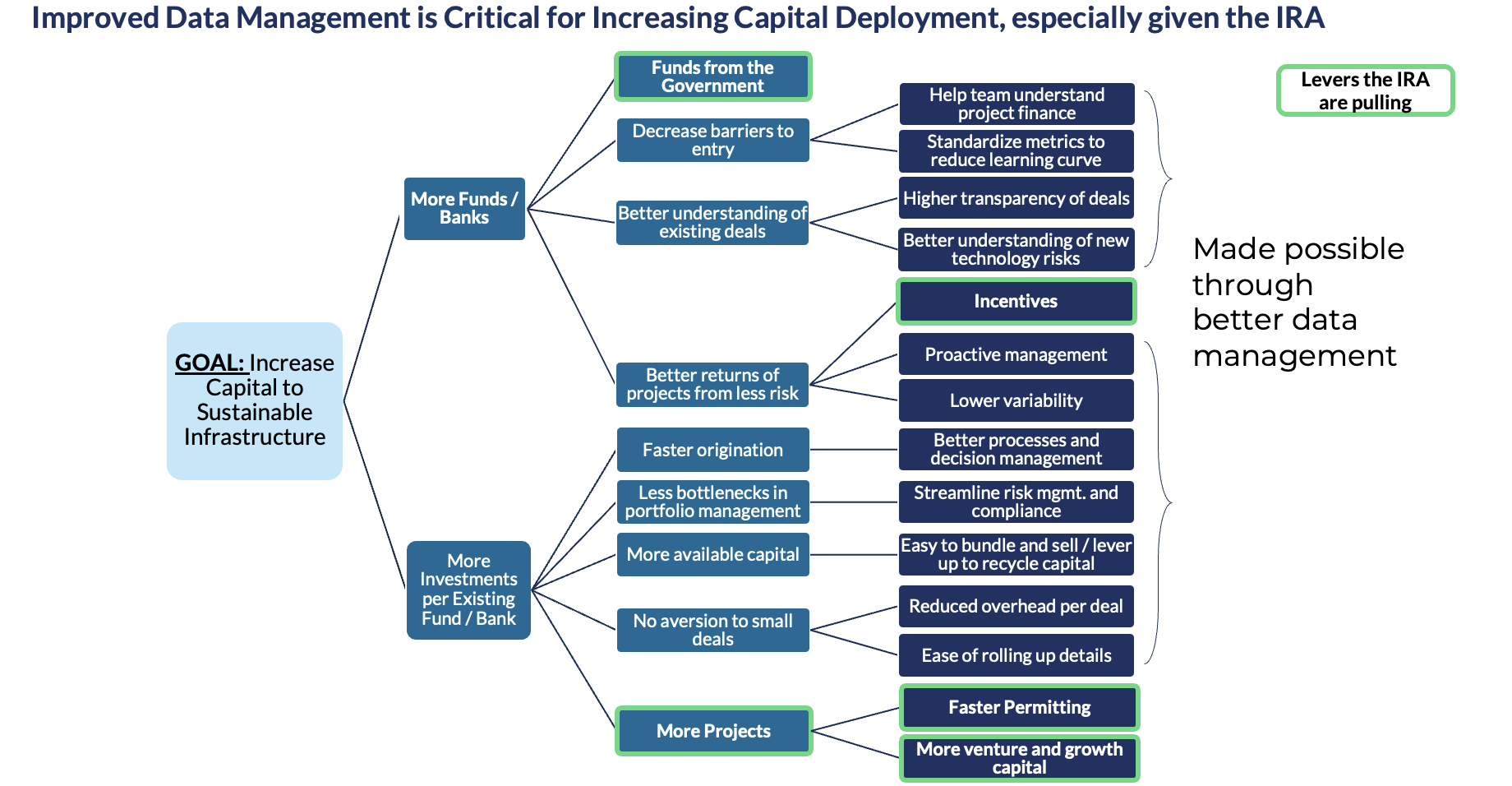

Banyan Infrastructure’s project finance innovations meet two goals: 1) to bring capital more efficiently to sustainable infrastructure projects; and 2) to improve data management to increase transparency and standardization, which lowers risk and increases liquidity by opening opportunities into secondary markets and ATS. These foundational elements of Banyan unlock the ability to increase the amount of capital being deployed and help bridge the gap needed to reach net-zero targets.

Specifically, Amanda is advocating for investors to get smarter and better at bundling smaller infrastructure investments into larger ones. “Instead of writing a $500 million check twice a year, we need to be able to write 1,000 $1 million checks,” she argues. “That’s where there is a lot of market growth and more developers looking for capital.” To do that, project finance experts need to better standardize the metrics of each transaction, increase transparency and thereby reduce risks. “A thousand distributed solar projects will have separate risk assessments which leads to a lot of overhead in terms of origination costs. It involves copying and pasting from hundreds of models and contracts. Issues involving permitting, manufacturing and supply chain as well as labor shortages are all serious, but to get capital to these much needed climate change projects, we have to create greater mobility of capital, a liquid marketplace for investors to move in the capital stack. For some investors today, even writing a $50M check is too small and difficult, and that’s a problem.”

While bankers and project finance experts are struggling to ramp up their climate change investments, Mother Nature is not taking a breather. Numerous climate change experts, preparing for November’s United Nations COP 27 meeting in Cairo, worry that the planet is about to pass “unforgiving deadlines for our ecosystems.” They point to this summer’s record floods in Pakistan as well as parts of the United States, wildfires in California, and unprecedented heatwaves in Europe and China.

Amanda understands the seriousness of her work and considers it “a privilege and a responsibility” to be a role model for women and underrepresented minorities, as both an impact focused leader and a senior executive. Without having role models herself, “It’s been difficult to figure out which styles to copy…how to negotiate…or how to present myself. All of my bosses and role models have been men!”

Amanda is proud that fully 50% of Banyan’s employees are women. “Such a large number of women is rarely seen in tech or finance or energy. Now Banyan is growing, so I can pay it forward for women in my company.”

Amanda concedes that “project financing is an insider topic for analysts. It is one of the final frontiers for SaaS and is often considered a niche area. But this topic needs to become enormous if we truly want to reach our climate change goals.”

About the Author

Jacqueline Adams (MBA 1978) has spent her career as a journalist, author, and convener. She and Bonita C. Stewart (MBA 1983) are co-authors of “A Blessing: Women of Color Teaming Up to Lead, Empower and Thrive” as well as a series of groundbreaking proprietary surveys, Women of Color in Business: Cross-Generational Survey©.